Special Feature

Featured

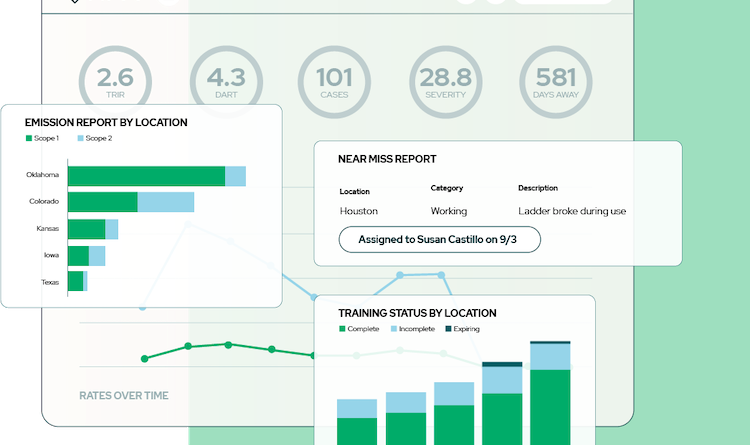

Making safety and training management easy and efficient with KPA Flex

KPA’s flexible EHS software platform (KPA Flex) was built from a need to create forms and training lessons that could be flexible enough to...

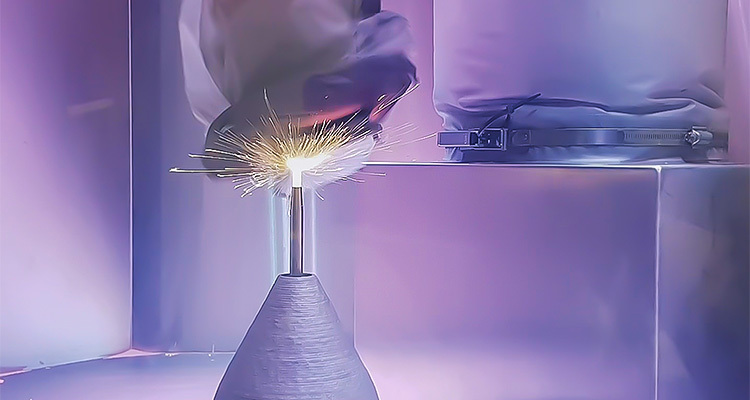

SPEE3D’s technology is shaping the future of how metal parts are produced

In the rapidly evolving world of manufacturing, the quest for efficiency, speed, and innovation is never-ending

Jason Davenport, CEO of the CIPP, reveals why it’s time to invest in your payroll department

Payroll is an almost invisible yet crucial element of the global economy

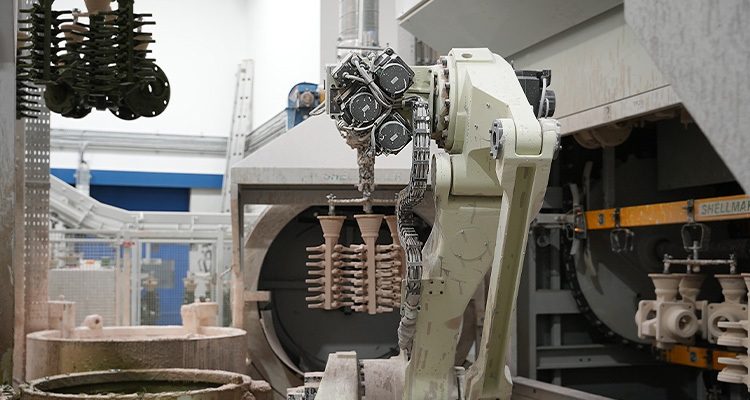

How the worldwide leader in ultrasonic technologies, The Crest Group, is revolutionizing the industry

Comprising 11 separate entities, The Crest Group (Crest) is the largest privately held company in the ultrasonic industry, specializing in innovative ultrasonic cleaning, thermoplastic...

Through transformative innovations, Pelsis is leading the way in sustainable pest management.

Pelsis is a leading manufacturer of commercial and retail brands, delivering innovative pest control and garden care products to its global customer base

Discover how Secop Group’s unique products are innovating the commercial cooling industry

With more than 65 years of experience in commercial refrigeration, Secop Group GmbH (Secop) is an expert in the development and production of advanced...

Manufacturing Today dives into the pivotal role Damen Naval plays in securing global waters

Seventy percent of the earth’s surface consists of water. Our waterways help connect communities, open trading opportunities, and generate energy

Listen to the latest podcast

Automotive

Behind the scenes: how KIRCHHOFF Automotive has adopted innovative solutions in the pursuit of excellence

Ever since the advent of cars, KIRCHHOFF Automotive Ltd has been at the forefront of developing, producing, and supplying metal parts, including hybrid structures,...

The Drive Towards Wireless Charging Highways

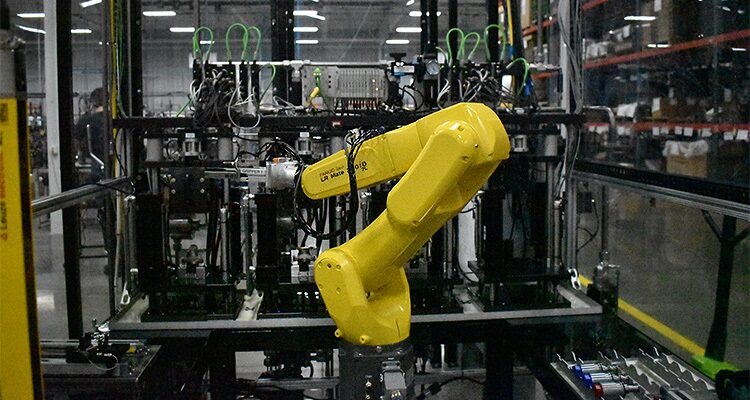

The transportation sector stands on the brink of a transformative leap forward with the strategic partnership between Detroit Manufacturing Systems (DMS) and InductEV. This...

How MCV takes the high road to disability and environmentally friendly manufacturing

Founded in 1995 by Egyptian entrepreneur Eng. Karim Ghabbour, Manufacturing Commercial Vehicles Ltd (MCV) is the largest bus manufacturer in the Middle East and...

BYD vs. Tesla: The Race for EV Dominance

The electric vehicle (EV) industry is witnessing a remarkable shift in power dynamics, primarily driven by the meteoric rise of China's BYD (Build Your...

Tesla’s California Factory Now Largest in America

In the rapidly evolving landscape of the U.S. automobile industry, Tesla's ascent to prominence stands as a paragon of innovation and market transformation. The...

Navigating the Aftermath: U.S. Manufacturing and the Auto Strike’s Ripple Effect

In the complex tapestry of U.S. manufacturing, the auto industry stands as a pivotal sector, contributing significantly to the nation's economic landscape. In September...

Discover how Granville Oil and Chemicals’ rebranding initiative revitalized its image

With a strong foothold in the automotive industry, Granville Oil and Chemicals Ltd (Granville) is a leading British manufacturer of high-quality motor oils

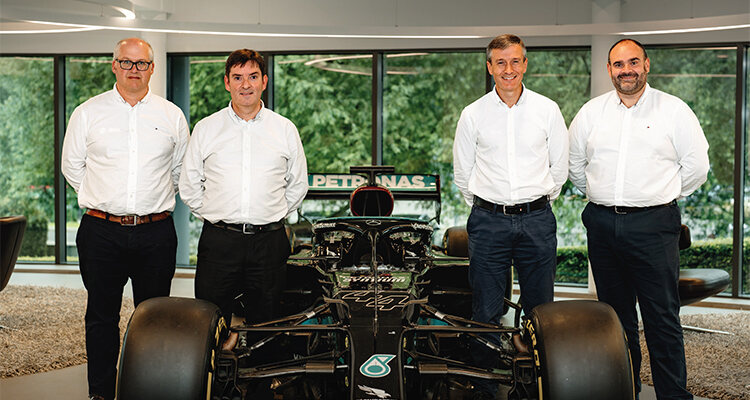

The cost cap, recruitment, and manufacturing innovation: 2023 has been more than just a race for the Mercedes-AMG PETRONAS Formula One Team and its top leaders. By Danielle Champ

When Lewis Hamilton took pole at the Hungarian Grand Prix in 2023, Rob Thomas was at home, watching the race, surrounded by his family,...

Aerospace

Turbulence Ahead For Boeing Facing FAA Probe Over Manufacturing Practices

In an unprecedented move, the Federal Aviation Administration (FAA) has launched a comprehensive investigation into Boeing's manufacturing processes, following a disturbing incident involving a...

Using its decades of experience, Woodward is embracing the new era of automation

Woodward is an independent designer, manufacturer, and service provider of control solutions and system components for aircraft engines, industrial turbines, power generation, and mobile...

Airbus Helicopters UK paves the way for sustainable solutions in aerospace

Aviation industry giant Airbus Helicopters has gained recognition throughout its decades-long existence, earning its position as a global leader in the sector

Power to the people: inside FEMA Corporation’s success story

Southwest Michigan-based FEMA Corporation of Michigan (FEMA) is a leading manufacturer of custom engineered electro-hydraulic components

People-first aerospace equipment manufacturer, ONTIC, discusses strategic success and operational optimization

Leading aerospace licensor and manufacturer, ONTIC, has skyrocketed to success over the past 12 months

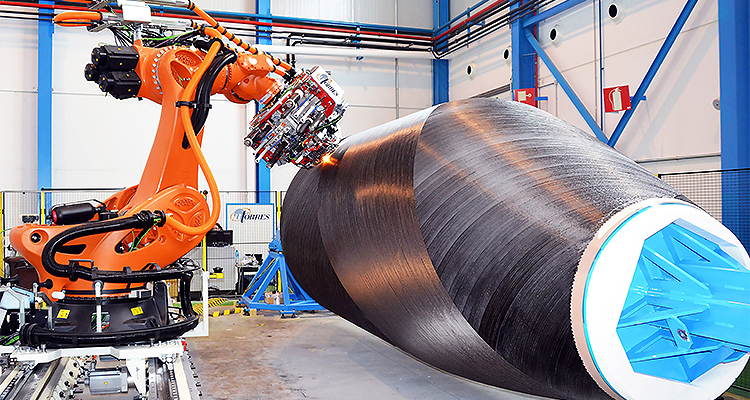

MTorres continues to reap the rewards of its diversification into aerospace manufacturing

Serving mainly the aeronautics and paper conversion sectors, MTorres is a leading global provider of innovative, integrated, and intelligent automation solutions for various industries....

Northern Ireland’s advanced manufacturing sector is playing a key role in the changing global supply chain

In Northern Ireland, companies are expanding into new sectors, providing more resilient supply chains, at a greater rate than ever before.

Business at Ontic is booming; here’s what the company predicts for the future of aviation

Ontic’s history stretches as far back as 1952. The company was established in southern California, outside Los Angeles, on the West Coast

Engineering

The future of manufacturing: Smart, sustainable, and resilient

The manufacturing sector stands on the edge of a revolution, driven by the seamless integration of several innovative technologies

Jason Davenport, CEO of the CIPP, reveals why it’s time to invest in your payroll department

Payroll is an almost invisible yet crucial element of the global economy

Discover how Secop Group’s unique products are innovating the commercial cooling industry

With more than 65 years of experience in commercial refrigeration, Secop Group GmbH (Secop) is an expert in the development and production of advanced...

How Fort Vale Engineering leads the way in the design and manufacture of valves and fittings for transportable tanks

Fort Vale Engineering Limited (Fort Vale) was formed in 1967 by Ted Fort, in Colne, Lancashire, who went on to receive an OBE for...

With a goal to beat net-zero targets, Kawasaki Precision Machinery UK is implementing innovation across its operations

Kawasaki is a well-known business for many reasons, and this month, Manufacturing Today had the pleasure of learning more about its machinery capabilities

Unveiling American Trailer World’s trailblazing journey of acquisitions and innovation

Officially in business since 2016, American Trailer World Ltd (ATW) is the largest manufacturer, retailer, and distributor of professional and consumer grade trailers, truck...

Manufacturing Today looks into innovation over at the UK’s leading bed manufacturer, Dreams, and it is never quite as it seems

In an evolving landscape, Dreams stands tall as the UK’s premier specialist retailer

Discover how Eltherington Group revolutionizes production, training, and efficiency in manufacturing

Renowned manufacturing company Eltherington Group Ltd (Eltherington), is a leading supplier of architectural aluminium and bespoke manufacturing services

Chemicals

Through transformative innovations, Pelsis is leading the way in sustainable pest management.

Pelsis is a leading manufacturer of commercial and retail brands, delivering innovative pest control and garden care products to its global customer base

From humble beginnings, learn how Varsal has become the specialty chemical and technical intermediate manufacturing partner of choice for a global customer base

Since its founding in 1993, Varsal has grown from a small analytical instrument company to a global custom chemical and instrument manufacturing business

Discover how Granville Oil and Chemicals’ rebranding initiative revitalized its image

With a strong foothold in the automotive industry, Granville Oil and Chemicals Ltd (Granville) is a leading British manufacturer of high-quality motor oils

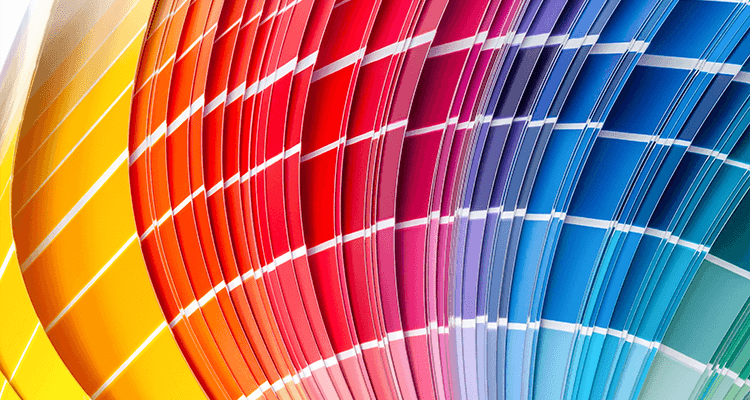

From VOC-free paints to peel-and-stick labels, explore Color Communications Innovations sustainable designs

Color Communications Innovations (CCI) prides itself on its mission to develop, manufacture and deliver superior quality products to any business with a need for accurate color

Brightwell’s sustainable innovation sets a new standard in hygiene

A trusted international leader in hygiene and chemical dosing solutions, Brightwell is recognized for its exceptional quality, customer focused products, and culture

A familiar change

Wally Brant shares how history is repeating itself for Indiana Oxygen

The manufacturing industry’s pathway to net zero By Hassan Badrawi

Today’s industries are focused on delivering their energy transition plans and are increasingly embracing innovative solutions to curb harmful emissions.

Central London to around the globe: the story of Scott Bader

What do the UK, France, Ireland, Middle East, Germany, North America, South Africa, Scandinavia, Croatia, Japan, Australia, Italy, India, and Turkey have in common?...